MegaPari Payments

MegaPari Kenya offers players a secure and convenient payment system tailored to local needs. From M-Pesa and Airtel Money to e-wallets and crypto, users can choose from multiple trusted methods for fast deposits and withdrawals. Transactions are processed quickly, with clear instructions and zero hidden fees. The platform ensures full control over your funds, whether you’re topping up your account or cashing out winnings. With reliable support and real-time updates, MegaPari makes managing payments easy and stress-free—so you can focus on enjoying the game.

AstroPay

Min. deposit: 646.25 KES Max. deposit: 50,000 KESCryptocurrency(BTC, BNB and LTC.)

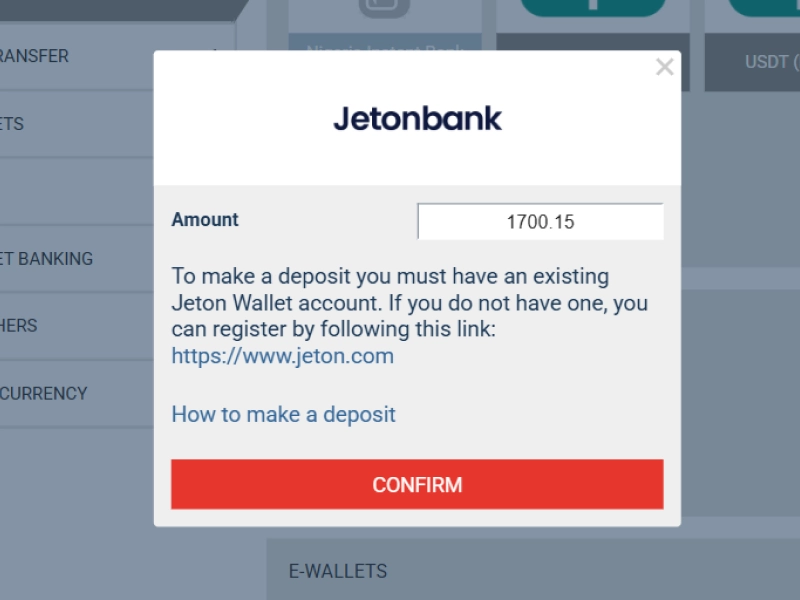

Min. deposit: 389 KES Max. deposit: 50,000 KESJeton

Min. deposit: 50 KES Max. deposit: 50,000 KESMasterCard

Min. deposit: 50 KES Max. deposit: 50,000 KESEquity Bank, I&M Bank, M-Pesa

Min. deposit: 50 KES Max. deposit: 50,000 KESVisa

Min. deposit: 50 KES Max. deposit: 50,000 KESMegapari is a modern online platform that offers a wide range of sports betting and casino games. It has gained popularity in Kenya due to its convenient payment system that is geared towards the needs of local users.

The platform offers fast deposits and instant payouts, providing convenient and smooth game balance management. Users can choose from a wide range of popular payment methods, including mobile wallets, bank transfers and other familiar localised solutions tailored to the needs of the region.

Megapari pays special attention to transaction security and transparency of all transactions. Customer support is always ready to help in case of any payment-related issues. This approach makes using the platform intuitive and reliable even for beginners.

Megapari payments Kenya withdrawal fee

For users from Kenya, Megapari platform offers exclusive bonuses, promo codes, convenient and transparent withdrawal terms and conditions. In most cases, there are no fees for withdrawals on Megapari. However, payment processors may charge them, especially for currency conversions.

It is also worth keeping in mind that Megapari payments Kenya charges may appear in certain situations. For example, if a player has funded an account but has not wagered the balance at least once, withdrawals may be rejected or processed with fees until turnover conditions are met. This is due to the platform’s policy to prevent money laundering and abuse.

Megapari payments Kenya withdrawal requirements

Before withdrawing funds from the Megapari platform, users from Kenya must fulfil a number of mandatory conditions. Firstly, users will be required to undergo a standard verification process — providing proof of identity, residential address and payment details. This is a common security measure used to protect the account and prevent fraud.

Withdrawal of funds is carried out exclusively to the same payment details that were used when depositing. If a player used several methods for deposits, payouts will be distributed in proportion to the amounts of deposits. Users must also comply with the withdrawal limits, both minimum and maximum amounts, in order for the transaction to be successful.

In addition, in some cases, the platform may temporarily freeze transactions and request additional verification. This is a standard practice aimed at protecting new and existing accounts from suspicious activity.

Avoid using other people’s payment data — such actions may result in transactions being blocked without prior notice. Users are advised to familiarise themselves with the withdrawal conditions in advance.

Megapari payments Kenya

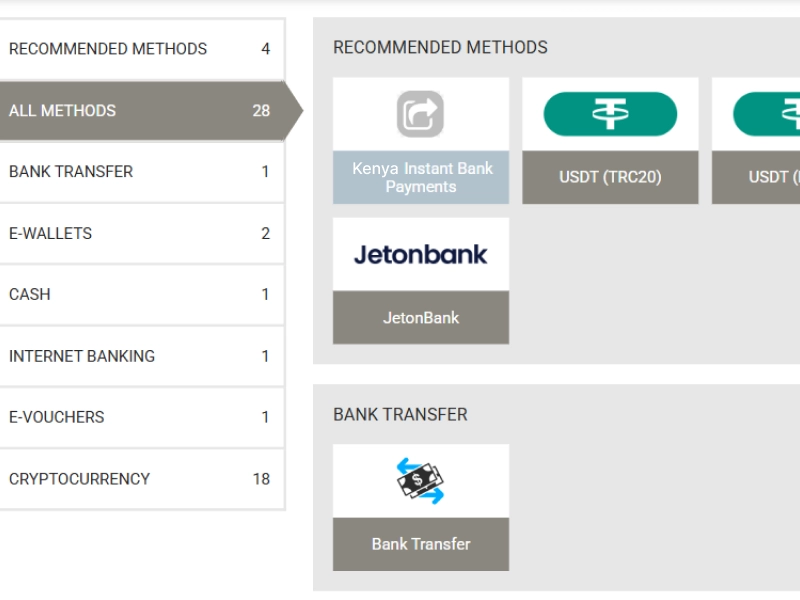

Megapari Kenya’s payment system is designed to cater to the habits and needs of local users. A wide range of deposit and withdrawal methods are available on the platform, from mobile payments to e-wallets and bank transfers. As a result, transaction methods on Megapari are flexible, fast and convenient.

Below is an overview of the most popular methods, including their limits and processing times:

| Method | Available For | Processing time (Deposit) | Processing time (Withdrawal) | Minimum limit(deposit) | Minimum limit (withdrawal) |

|---|---|---|---|---|---|

| M-Pesa Manual | DepositandWithdrawal | Up to 10 minutes | Up to 1 business days | 50 KES | 225 KES |

| Equity Bank | DepositandWithdrawal | Up to 10 minutes | Up to 3 business days | 50 KES | 100 KES |

| I&M Bank | DepositandWithdrawal | Up to 10 minutes | Up to 3 business days | 50 KES | 100 KES |

| Astropay | DepositandWithdrawal | Up to 10 minutes | Up to 1 business days | 646.25 KES | 646.25 KES |

| Cryptocurrency (BTC, BNB and LTC.) | DepositandWithdrawal | Up to 10 minutes | Up to 2 hours | Equivalent of 389 KES | Equivalent of 642.63 KES |

Payments Guide

FAQ

How long does it take to get money from Megapari?

Withdrawal time depends on the chosen method: mobile payments, such as M-Pesa, usually take up to 24 hours, while bank transfers can take up to 5 working days. If the account is not verified, the time may increase due to the need for identity verification

How to deposit money to Megapari in Kenya?

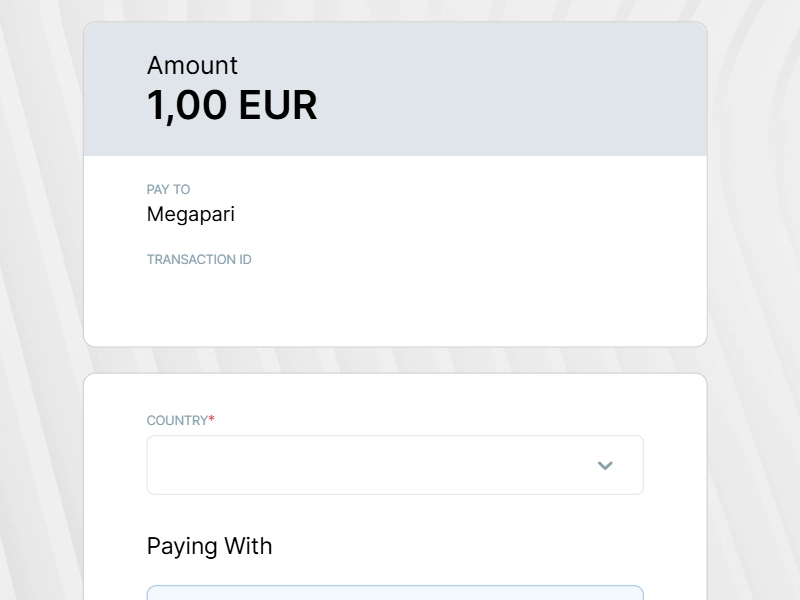

To make a deposit, you need to log in to your Megapari account, go to the ‘Make a deposit’ section and select a suitable method, such as M-Pesa or I&M Bank. Then enter the amount that meets the minimum requirements, follow the on-screen instructions and confirm the payment – the funds arrive almost instantly

What is the minimum deposit in Megapari?

The minimum allowed deposit on Megapari is 50 KES, but the exact value varies between payment methods.